Vibe coding flow state

Read →

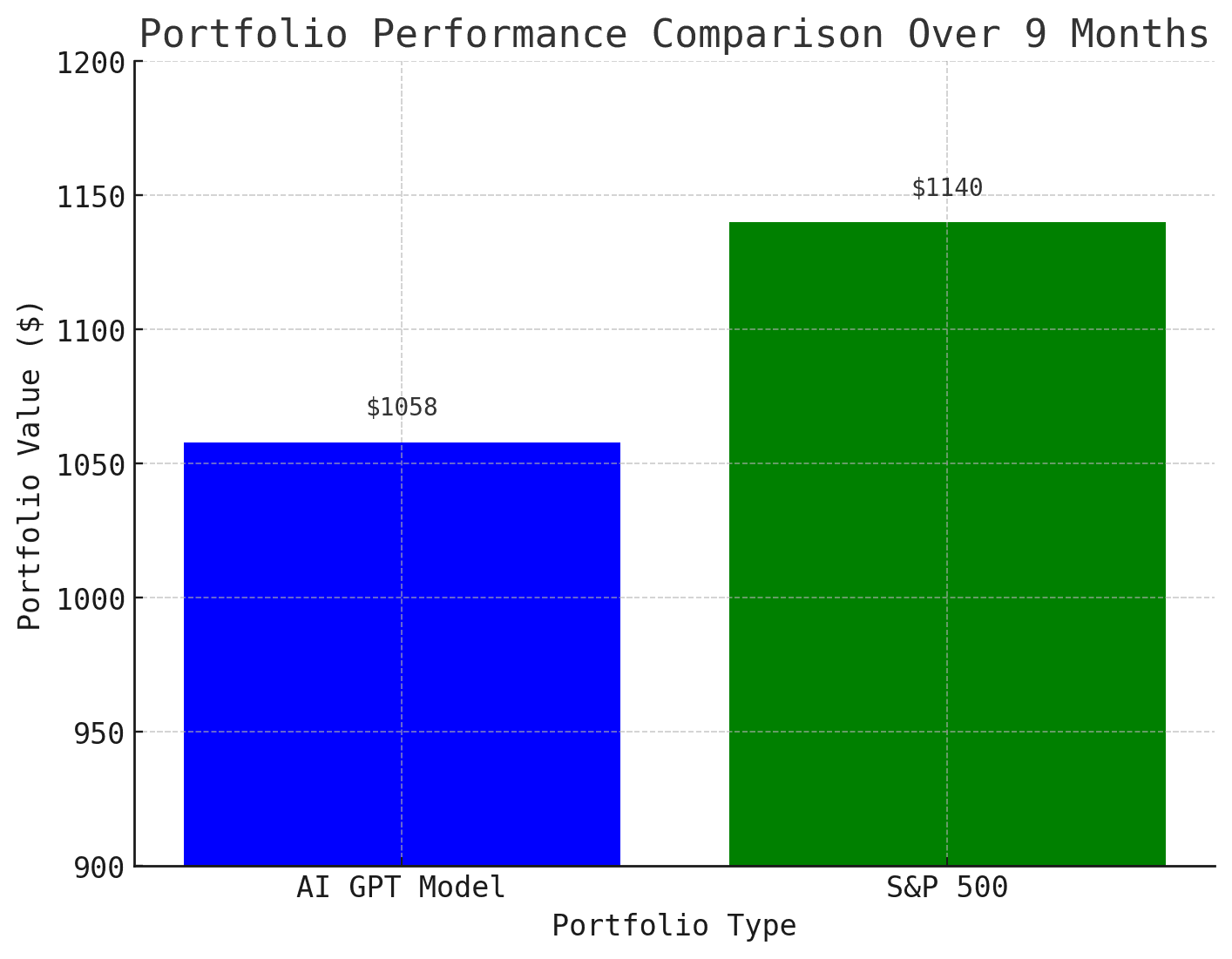

Nine months ago, I decided to run an experiment giving ChatGPT $1,000 to see how it would manage my money. I used an application named Autopilot, which integrates a GPT model with my Robinhood account to autonomously execute trades.

This GPT model scores each stock in the S&P 500, using a combination of the stock's fundamentals and eight key macroeconomic data points, like interest rates, unemployment numbers, and national finance headlines. Based on these scores, the model invests in the top 15 stocks and rebalances the portfolio each month with the latest scores

After nine months, GPT made 5.8% return on my investment. While positive, this was notably less impressive than the S&P 500's 14% increase over the same period. Essentially, by not simply investing in the S&P 500 (a basket of the top 500 funds in the market), I missed out on an additional 9% gain.

I'm withdrawing my position from GPT and won't allocate more of my money to the fund. However, I would recommend Autopilot for other investment strategies. It's made me returns that outpaced the S&P500. It has proven useful for replicating trades of major Wall Street funds like Citadel and investors like Michael Burry, whose strategies have been more lucrative. Interestingly, it also allows for tracking and emulating trades of politicians with insider knowledge, like Nancy Pelosi.